Rachel Reeves is looking to fill a £40bn black hole in the country’s finances, Sky News understands.

According to people close to the budget, the gap in funding identified by the chancellor is more than twice what was previously thought.

Politics latest: Stark warning issued over national insurance rise

Ms Reeves has previously said the Conservatives left the new government with a £22bn shortfall, requiring “tough decisions” like axing the winter fuel payment.

This has led to speculation Labour may introduce measures such as a national insurance increase for employers to raise more cash.

The Treasury does not comment on budget speculation.

According to the Financial Times, the £40bn figure represents the funding the chancellor needs to protect key government departments from real terms spending cuts, cover the impact of the £22bn overspend from the last administration and build up a fiscal buffer for the rest of parliament.

The paper said she was eyeing big tax rises to patch up the NHS in particular.

However, the government has left itself with little wiggle room after ruling out a rise in national insurance, income tax and VAT in its manifesto.

Ministers have since said that this meant not “increasing tax on working people” – leaving the door open for the employer element of national insurance to go up.

Read more from Sky News:

Labour is desperate for hope – the budget will be biggest test yet

What are Labour’s fiscal rules and could Reeves change them?

A one percentage point increase in the Class 1 rate could raise £8.45bn over the 2025 to 2026 tax year, and a two percentage point hike could raise £16.9bn, according to data compiled by HMRC and EY.

Meanwhile, introducing national insurance on employer pension contributions could raise around £17bn per year if taxed at the same 13.8% rate, according to the Institute for Fiscal Studies (IFS).

Experts have cautioned that any increase in employer national insurance would mean higher costs for businesses, which could impact their staff and customers.

Paul Johnson, director of the IFS, told Sky News on Tuesday night that the tax rise could lead to less pay rises and fewer jobs.

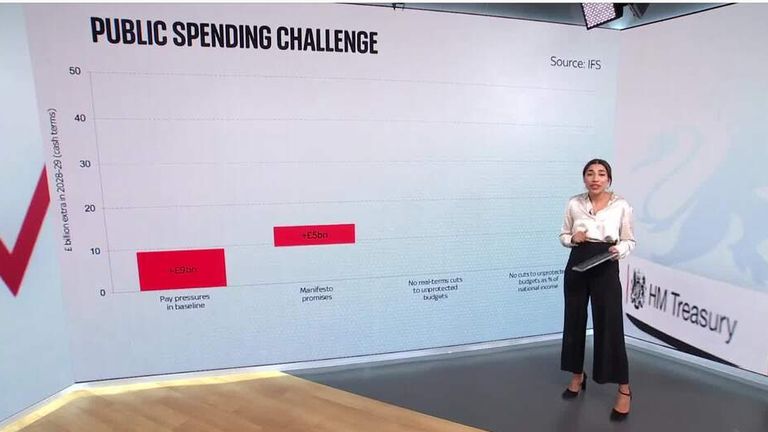

The influential thinktank estimates Ms Reeves may need to raise up to £25bn from tax increases if she wants to keep spending rising with national income, and honour Labour’s pledge not to return Britain to austerity.

As well as tax rises, there is also speculation Ms Reeves could change her fiscal rules to enable more borrowing.

It is thought the chancellor could change how debt is calculated, which could in turn alter how much debt the UK officially has and give Ms Reeves room to borrow more.

The post Chancellor Rachel Reeves looking to ‘find £40bn’ in budget | Politics News appeared first on World Online.