Government borrowing in November was the lowest for that month in three years, according to official figures.

November borrowing was £3.4bn less than the same time last year, the Office for National Statistics (ONS) said. The state borrowed £11.2bn more than it took in last month.

The deficit fall was not anticipated by analysts who had expected it would total around £13bn.

November debt has not been at that level since 2021. At that point, however, the government was borrowing to fund a COVID-19 furlough scheme and its response to a global pandemic.

Money blog: Teenage darts star can make millions without competing

Behind the fall last month were higher tax takes and lower payments on debt – balanced against increased public spending, which pushed up the sum.

The news may be a gift to Labour who have sought to bring down public sector debt.

But the trend is unlikely to continue and costly borrowing will likely hike debt and expand the gap between income and expenditure.

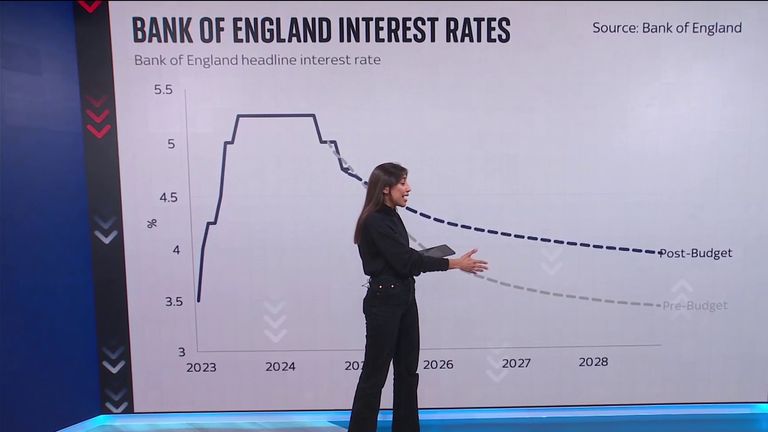

The amount investors require the government to pay on loans it issues, bonds, has risen to a high not seen in more than a year.

UK yields – the effective cost of servicing government debt – have risen sharply in December after a run of news pointed to a weakening economy.

Treasury deputy Darren Jones repeated the chancellor’s statement that it inherited a £22bn “black hole” in the public finances – a gap between spending and revenue.

“This government will never play fast and loose with the public finances,” he said. “Now we have wiped the slate clean, we are focused on investment and reform to deliver growth”.

The post Government borrowing in November hits three-year low | Money News appeared first on World Online.