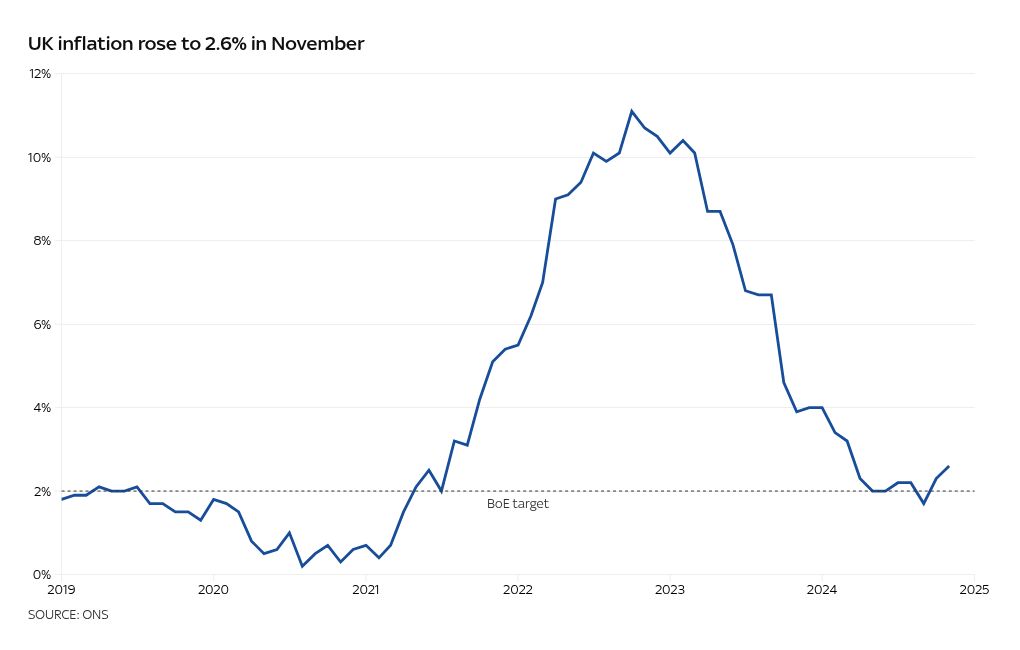

Inflation has risen for the second month in a row, according to official figures.

The overall rate of price rises – as measured by the consumer price index (CPI) – grew by 2.6% in November, a significant rise.

It’s a further move away from the Bank of England‘s target 2% inflation rate after the rate ticked up to 2.3% in October, the first increase in three months.

This is due to the higher cost of clothing, petrol and diesel, compared to last year, the ONS said.

Costlier tobacco products elevated through higher tobacco duty announced in the October budget also contributed.

Acting to slow price rises were plane tickets, which had the largest drop in the month since records began.

While the main measure of inflation, CPI, was as economists expected, other measures were lower than forecast.

Another important measure of inflation watched by the rate-setters at the Bank is core inflation, which measures price rises but excludes food and energy costs as they’re liable to sharply fall or rise.

Core inflation rose to 3.5%, less than the 3.6% anticipated by economists polled by Reuters.

Similarly, services inflation, which is impacted by rising wages, remained at 5% despite a forecast rise.

In response to the data Chancellor Rachel Reeves said: “Today’s figures are a reminder that for too long the economy has not worked for working people”.

“At the budget we protected [working people’s] payslips with no rise in their national insurance, income tax or VAT, boosted the national living wage by £1,400 and froze fuel duty.

“Since we arrived real wages have grown at their fastest in three years. That’s an extra £20 a week after inflation. But I know there is more to do.”

The post Inflation rises for second month in a row | Money News appeared first on World Online.