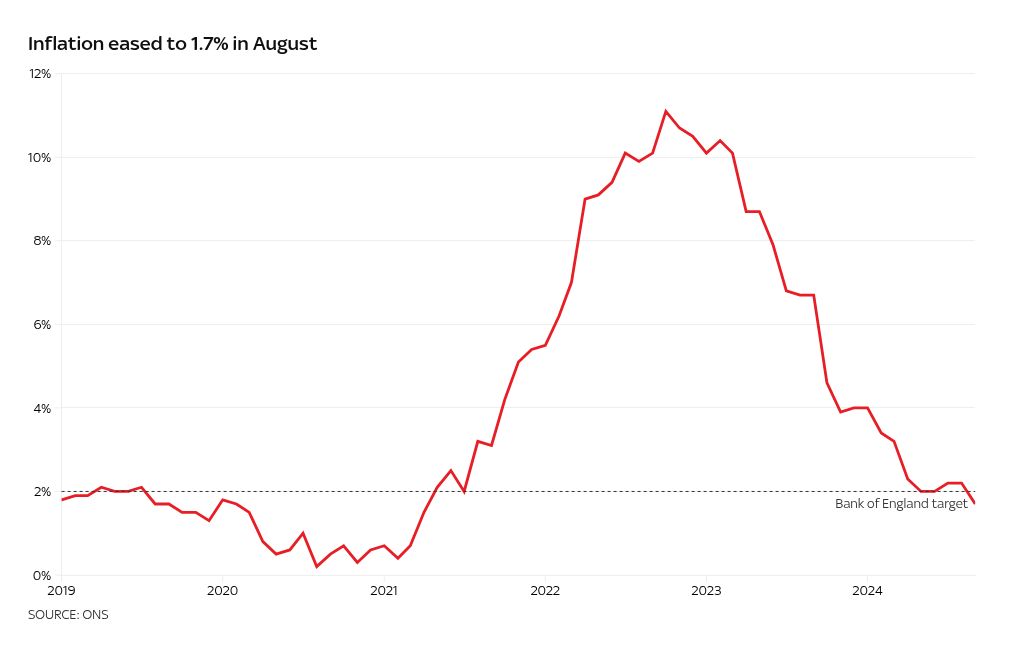

UK inflation has eased to 1.7%, dipping well below the Bank of England target for the first time since 2021, according to the Office for National Statistics (ONS).

It’s a drop on the 2.2% recorded in last month’s Consumer Prices Index (CPI).

The Bank of England has been trying to bring inflation down by keeping interest rates higher.

Money blog: Shock fall puts inflation below target for first time in three years

It recently trimmed the base borrowing rate to 5% and today’s inflation figure is expected to increase the likelihood of further cuts – welcome news for people with mortgages.

A lower inflation rate doesn’t mean prices are falling – only that they are rising more slowly.

Inflation peaked at 11.1% in October 2022 after energy prices soared due to the start of the Ukraine war.

It fell to 2% in May and July this year, but then edged higher again.

The last time it was below the target – which is set by the government – was April 2021, when it was 1.5%.

The latest drop in inflation, which covers the 12 months to September, was mainly driven by falling fuel costs.

Mortgage holders can now look forward to what looks like an almost certain cut in interest rates from the Bank of England when it meets on 7 November.

A reduction from 5% to 4.75% was already viewed by financial experts as highly likely.

This breaking news story is being updated and more details will be published shortly.

Please refresh the page for the fullest version.

You can receive breaking news alerts on a smartphone or tablet via the Sky News app. You can also follow @SkyNews on X or subscribe to our YouTube channel to keep up with the latest news.

The post UK inflation drops to 1.7% – well below target for first time since 2021 | Business News appeared first on World Online.