Key takeaways

There are a lot of factors to consider when setting a pay schedule, including government regulations and laws, the needs of the business, the nature of the work, and the needs of the staff.

Pay schedules can be modified, but check applicable regulations to be sure the process is handled properly to avoid legal issues.

Staff often prefer shorter pay periods, but those also tend to drive up overhead. If a weekly or biweekly payroll schedule isn’t necessary, it’s usually best to choose a longer pay period.

Everyone loves a payday, but how do you decide how often they should happen for your business? Is it better to pay more frequently, making paychecks smaller in value individually? Or is it worth it to run payroll less frequently, thereby minimizing the number of times it has to be processed in a year?

These are important questions, and ones without universal answers. So, let’s dive into what to consider when setting payroll schedules, the types of payroll schedules at your disposal, which schedules match your situation, and how to choose and implement one to support your business needs.

What is a payroll schedule?

A payroll schedule is a recurring financial schedule for businesses, at the end of which, paychecks are calculated and issued for staff who worked for the company. This may happen monthly, weekly, or sometime in between.

To be more specific, payroll is for internal, on-staff employees (e.g., W-2 employees in the U.S.); this doesn’t typically include contractors and freelancers. These external contributors typically invoice the company as a vendor or business partner would, and issuing payment to them may or may not happen on a set schedule. Even when a freelance payment schedule is in place, it’s usually entirely separate from the payroll schedule.

In the past, businesses would write or print physical checks for employees to cash (hence the term “paycheck”). These days, payroll is most often handled electronically, with payroll software or some other solution issuing direct deposits at the end of each pay period.

Types of payroll schedules

There are primarily four types of payroll schedules:

Monthly.

Semimonthly.

Biweekly.

Weekly.

Monthly schedule

Monthly payroll happens once each month.

Payroll date

Monthly paychecks happen on the same date each month, typically the beginning, the mid-point, or the month’s end.

Total yearly pay periods

Monthly payroll runs 12 times over the course of a calendar or fiscal year. This schedule favors salaried employees, those with large commissions and recurring bonuses, and even freelancers in some cases.

Pros

Fewer transactions mean fewer payroll periods and fewer payroll calculations, possibly leading to lower payroll expenses.

Team members never need to guess when the next paycheck will roll out, since it’s the same day each month.

Additional calculations, such as commissions and benefits deductions, are easier to make because they don’t have to be spread over multiple pay periods. There are accounting benefits to monthly payroll, such as tracking labor costs by month more easily.

Cons

This schedule is the one most frequently prohibited by laws and regulations, which often mandate more frequent payments to staff.

No one likes waiting for their paycheck, and depending on when a new team member starts, monthly payroll may leave them waiting for a month or longer for their first check.

For staff who are more financially sensitive to changes or errors, a minor glitch, error, or missed payment could spell disaster if they have to wait another month for a fix.

Semimonthly schedule

Semimonthly is a very common schedule, consisting of two payments per month, roughly 15 days apart. This schedule benefits salaried employees, especially when the company offers a significant amount of noncompensatory benefits.

Payroll date

The recurring pair of pay dates vary by organization, but it’s usually one of the following:

1st and 15th.

5th and 20th.

10th and 25th.

15th and 30th.

Total yearly pay periods

With each month broken into two pay periods, companies run payroll 24 times by year’s end.

Pros

Shorter pay periods mean new hires see their first checks in as few as two weeks.

Deductions, commission and bonus pay, and other calculations are easy to make, as any monthly value is simply spread over two pay periods.

Cons

Monthly dates don’t change, but the day of the week for payroll does, making payroll a bit hard to predict both for employees and finance teams.

Not all months have the same number of days, and some payroll dates fall on weekends or bank holidays, resulting in some minor inconsistencies on paycheck amounts and pay dates, depending on company policy.

Hourly employees often have their work weeks split across multiple pay periods, especially when payroll runs in the middle of the week, complicating payment calculations such as overtime pay.

Biweekly schedule

This payroll schedule runs every two weeks, irrespective of months or other calendar divisions. It offers greater benefits for teams with primarily hourly staff who may need to calculate overtime regularly.

Payroll date

This payroll schedule is usually run so checks can be issued and pay deposited at the end of a pay week. This means that most biweekly payroll runs are every other Friday.

Total yearly pay periods

Since this payroll schedule is broken up into 14-day increments rather than less consistent monthly cycles, it results in 26 pay periods.

Pros

Overtime, holiday work pay, and other pay considerations that factor heavily into hourly employees’ compensation are easier to track and calculate using a biweekly method.

Facilitates putting all staff on an identical pay schedule, minimizing accounting labor for different categories and pay scales of staff.

Benefits workers with fluctuating or intermittent schedules.

Employees receive a “bonus” paycheck two months of each year.

Cons

Benefit calculations are more complex, especially for months with three pay dates.

Having to run payroll three times in a month can be a difficult business expense to justify.

Pay periods that stretch into the next month make calculating taxes, fees, and month-specific details difficult.

Weekly schedule

Weekly pay schedules run every seven days. As the most immediate form of common recurring payment, this approach is most beneficial for businesses and industries where work shifts are variable, labor is seasonal, or work hours fluctuate dramatically.

Payroll date

Pay periods for weekly schedules usually start on Saturday, Sunday, or Monday, with the week’s end usually happening on Friday. In other words, after your first week at a job, with weekly payroll, every Friday is payday.

Total yearly pay periods

Since checks are cut every week, there are 52 checks issued to staff from January 1st to December 31st.

Pros

Shift workers, hospitality staff, part-time crews, and even freelancers all prefer weekly payment rather than having to wait several weeks for compensation.

As the most frequent schedule, weekly payroll minimizes the value, and thus the expense, of each payroll run.

Any inconsistencies, errors, or anomalies in hours, calculations, or otherwise are only one week away from the appropriate adjustment with the next check.

Cons

Calculating payroll is a job unto itself, and the more frequently it happens, the more labor is required over the year.

If the number of transactions is a factor in the cost of using digital services to run payroll, this pay frequency maximizes that cost by running the highest volume and frequency of payments.

While weekly paychecks make cash flow more predictable and steady for staff, it doesn’t necessarily do the same for the business (i.e., if there’s ebb and flow to the business’s income, weekly paychecks may be difficult to cover during a drought).

More payroll coverage

Which pay schedule should you use?

This is a hard question to answer unless you’re seeking information about specific industries or services; however, there are two general rules:

The less stable or predictable your business’s cash flow, the more it benefits from longer pay periods.

The less consistent the work schedule or paycheck value, the more beneficial shorter pay periods are for your staff.

How to choose a payroll schedule

To choose a payroll schedule, first consider your business needs, including your cash flow and HR limitations. Then, assess your employees’ needs, global and state labor laws, and any limitations associated with the payroll tools you use. Here’s a look at each of these steps and how to complete them.

1. Consider your business needs

When deciding a payroll schedule, consider the following business needs, including your company’s cash flow schedules and labor limitations.

Cash flow

Some businesses have more leeway than others when it comes to covering payroll costs. For example, a large retailer likely has funds flowing in daily, making it easier to choose a bi-weekly pay period. Some other businesses, like startups, may have to work the entire month to gather enough inflowing cash to cover payroll costs.

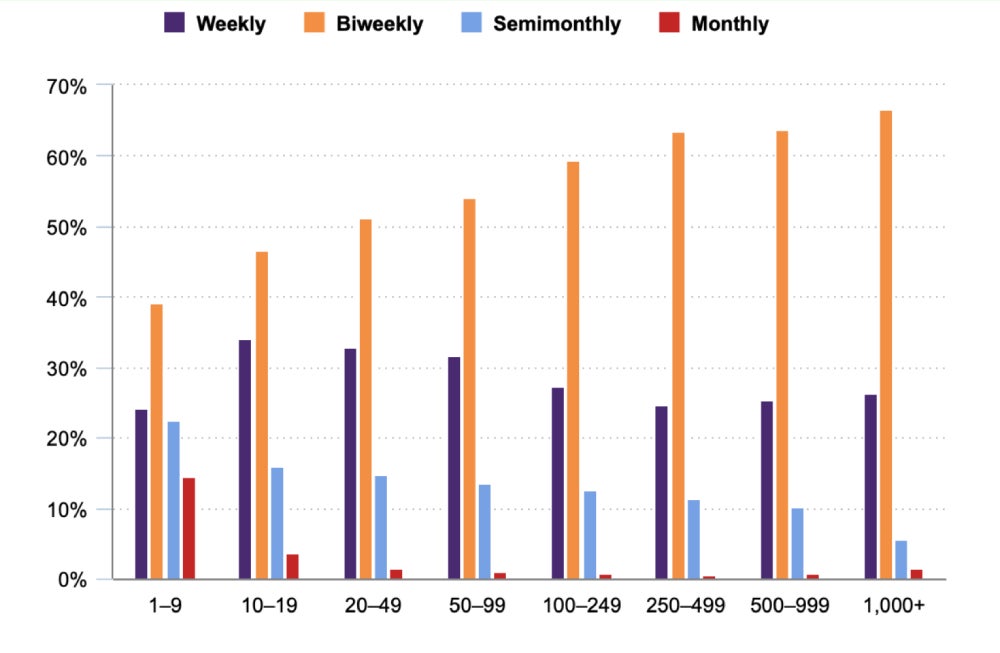

To illustrate this truth, consider these 2023 pay frequency statistics from the U.S. Bureau of Labor Statistics:

Companies with more than 50 employees are more likely to pay employees bi-weekly.

Companies with more than 20 employees are exponentially less likely to pay monthly.

Payroll frequency by number of employees in 2023. Image: U.S. Bureau of Labor Statistics

HR limitations

Your HR department must juggle many responsibilities, such as setting and upholding behavior policies throughout your organization, recruiting and onboarding new hires, managing employee conflicts, and ensuring employee performance reviews are scheduled and completed on time. Running payroll several times a month may not be feasible within their time constraints.

On the other hand, if they have access to payroll automation tools, running payroll multiple times a month may not require more labor or time invested. Or, perhaps you lean on a professional employer organization (PE) like ADP TotalSource to run your payroll, thereby easing your internal HR staff’s responsibilities, even if you implement more frequent pay runs each month.

So, when choosing a payroll schedule, consider your HR staff’s current obligations, their bandwidth to meet those expectations, and the tools they can employ to ease their workloads.

2. Consider your employees’ needs

Now that you know what pay schedules are doable for your HR department, it’s time to match one of those pay schedules to your employee preferences as closely as is feasible. Considering your employees’ preferences when choosing a payroll schedule can help you both retain and attract top talent. When considering your employees’ needs, carefully balance their preferences against your company’s bandwidth to run payroll.

To explore employee preferences, consider the types of employees you employ. For example, hourly employees and shift employees often have variable paychecks each payday and smaller paychecks than their salaried counterparts; as such, they may prefer a weekly or bi-weekly pay schedule to ensure smaller pay gaps when living paycheck to paycheck. On the contrary, salaried employees may prefer a monthly schedule or one that runs every 15 days so they can predict their pay amounts each pay period.

Another factor to consider is market expectations. Some industries routinely offer certain pay periods over others, and these expectations are shared by experienced industry employees. For example, companies in the medical, construction, hospitality, trucking, and customer service industries often pay weekly.

3. Consider state regulations and laws

Each state issues its own laws regarding how often you must pay employees, often the minimum pay period allowed. While you can pay employees more frequently than the state allows, you cannot pay them less frequently. For example, here are some pay frequency laws by state:

Alaska: Requires pay either semi-monthly or monthly at a minimum.

Arizona: Requires at least two pay periods per month no more than 16 days apart.

California: Companies must pay employees at least twice a month on the days designated as regular paydays with some exceptions.

Kansas: Requires employers pay employees at least monthly.

Texas: Requires employees be paid semi-monthly, semi-weekly, or monthly. However, only employees who are exempt from overtime according to the Fair Labor Standards Act (FLSA) can be paid monthly; all other employees must be paid more frequently.

4. Consider your payroll tool’s scheduling limitations

Now that you know your company’s HR bandwidth, your employees’ preferences, and your state’s requirements, think about the payroll tool’s scheduling limitations.

Number of monthly pay runs

Some payroll providers allow for only monthly payments, while others offer unlimited payroll runs per month. If your company uses payroll software that allows for unlimited monthly payroll runs, you have more options, allowing you to even pay employees weekly. If your chosen payroll tool cannot accommodate your pay frequency needs, you may need to upgrade your plan or consider another provider.

Automations to scale

In addition, consider what tools you have at your disposal to run payroll efficiently; this allows you to better understand what payroll frequency your staff can handle. For example:

While Patriot allows you to pay employees as many times as you want during the month, it does not offer automated payroll features in either of its payroll plans.

Gusto costs almost twice as much as Patriot per month but offers unlimited payroll runs per month and the option to run payroll on autopilot.

If you’re curious about Patriot and Gusto, check out their websites below.

4 steps to implement a payroll schedule

To implement a payroll schedule, follow these steps:

Use the information and insights from your payroll schedule selection process to either confirm the tools you have will work well or select new ones.

Set up your payroll tools to accommodate your scheduling needs.

Set your payroll schedule.

Communicate your pay schedule policies to your employees.

Here’s a detailed look at how to complete each of these steps.

1. Choose your payroll tool

Your first step to implementing your payroll schedule is to choose a payroll software or service that can accommodate your pay frequency. Also consider if your chosen payroll tool offers features that allow you to automate payroll as needed.

If your current payroll plan doesn’t accommodate your chosen pay frequency, another tier or an add-on may convert it into one that does. So, check with your provider to determine its further capabilities and limitations.

2. Set up your payroll tools

Once you’ve selected your plan, most payroll software offer a guided setup. For example, when you opt into a Roll by ADP payroll plan, you must first download the Roll by ADP app from either the Apple App Store or the Google Play Store. Then, the app guides you through setup using a chat-based conversation. For example, to add employees, you can simply send a “hire employee” message within the app and the system will guide you on how to add your employee.

If you are migrating from one payroll provider to another, most providers offer data migration services. For example, Rippling extracts all data from your old provider and imports it into your Rippling software account. Then, to ensure payroll accuracy, you can run a comparison report between the last paycheck you processed with your prior payroll software and Rippling’s first payroll run.

3. Set up your payroll schedule

In this step, set up your payroll schedule within your chosen payroll tool. Most payroll software allow you to fill out forms to set your payroll schedule. For example, in OnPay, to set up a bi-weekly or weekly pay schedule, you must first click “add new” after clicking to expand the “next scheduled payroll run“ tile within your OnPay dashboard.

From there, you’re prompted to fill out a simple form to name your pay schedule, your pay frequency, and the dates you want your first pay period to begin and end. Then, click “update” and review your pay periods on the provided calendar for accuracy.

OnPay Create a Pay Schedule form. Image: OnPay

4. Communicate payroll schedule policies to employees

It’s important to include payroll schedule policies in your hiring documents. When you do, note any holidays that may alter your pay schedule and offer an explanation of how you will handle these alterations.

Next, you can provide employees with a payroll calendar for the year; many payroll software providers offer them for free. For example, QuickBooks Payroll offers free pay schedule templates for a variety of pay frequencies. You can download and print them, or create them in Word or Google Sheets for digital distribution.

In addition, many payroll software offer employees a self-serve portal that delineates when their payday is and the amount they will receive each pay period. Employees can access this information 24/7, even when your HR representatives are not in the office.

Payroll schedules: Frequently asked questions (FAQs)

What is the most common payroll schedule?

Biweekly and semimonthly are the most common pay schedules, with the former being more popular among hourly labor forces and the latter being more frequently used among salaried workers.

What is the best payroll schedule for hourly employees?

Weekly and biweekly pay schedules are better suited to hourly teams and crews, providing faster payments, easier accounting, and more predictable expenses overall.

How does a payroll schedule work?

Regardless of the type of compensation, the variables involved, or the local regulations, payroll for any given employee is defined by a set start and end point for the timeframe. Whatever calculations are involved in determining their pay amount is then applied within that timeframe, and the paycheck issued.

Payroll schedules are a predetermined format for setting the start and end date of these pay periods, so the business, the staff, and the relevant governing bodies know what to expect.

How do I choose a payroll schedule?

To choose a payroll schedule, first consider your business needs, including your cash flow schedule and your HR department’s time constraints. Then, also consider state laws around minimum pay periods per month, your employees’ needs and preferences, and what capabilities you have in your payroll tools to enact specific schedules, such as how many pay runs are permitted per month and if automation tools are available.

How do you change your payroll schedule in payroll software?

Most apps have a native process for setting and changing a payroll schedule, though steps within each software’s user interface vary by vendor, app, and software version. Keep in mind that making a change often requires that tax bureaus and governing bodies be notified to avoid adverse legal consequences.

How do I create a payroll calendar?

The easiest way to create a payroll calendar is to employ payroll software that allows you to specify a payroll run cadence, such as weekly, bi-weekly, or monthly, then automate the calendar creation process. Most of these tools also provide an employee self-service portal that gives employees access to this calendar and provides reminders of upcoming pay days. Another means of creating a payroll calendar is by using a payroll calendar template that aligns with your pay frequency, like the ones provided by QuickBooks Payroll.

What are common processing fees with payroll?

Labor from financial professionals, bank account and transaction costs, and software subscription fees are all pieces of this puzzle, especially if businesses want payroll to be digital, let alone automated. In some cases, businesses save money if they run payroll 12 times a year as opposed to 24 times.

The post What Is a Payroll Schedule and How to Choose One appeared first on World Online.